The construction industry is a risk-intensive business, where owners have to make sure that their investment is secure while contractors are trying to maximize their profit margins.

Considering the sensitive nature of construction projects, where each party has its own vested interests, each of them also tries to add more layers of security for their benefit.

One such measure is the use of a retainage fee, which is a percentage of the contract amount that an owner withholds from a contractor until the completion of the project. The purpose of retainage is to ensure contractors fulfill all their contractual obligations, including timely completion and quality work.

From an owner’s perspective, retainage in construction serves as a form of security against potential risks such as contractor default or incomplete work. Meanwhile, contractors can fairly argue that retainage poses a significant financial burden and cash flow issues for them.

After all, who said contractors have lower risks of underpayment and they don’t need their own security measures from owners?

This article discusses construction retainage, where it comes from, whether it is still relevant in today’s construction industry or maybe there are better ways to secure both owner’s & contractors’ interests.

Retainage fee, we can also call it contract retention or holdback, is usually 5-10% of the contract value (but can vary from project to project, from country to country and state to state) that an owner holds or retains from the general contractor’s payment until the project is substantially complete.

The word “substantially” is the key word here since it indicates that retainage is not released upon completion of the project but only when it reaches a certain level of completion defined in the contract.

Usually, substantial completion is when the project is ready for its intended use or occupancy, even though minor work items may still need to be completed. This largely depends on how the contract for the specific project defines substantial completion.

It’s of the utmost importance to ensure no ambiguity in the contract language when it comes to defining what is meant by “substantial completion,” as it could result in disputes between owners and contractors, resulting in receiving your complete payment, including construction retainage, later than expected (or not receiving it at all, pardon our pessimism).

Here are some nuances you should know about retainage.

A quick explanation of terminology before we move forward:

Quite often, you will see the terms of construction retainage and construction retention used interchangeably. While retainage refers directly to the sum of money withheld, retention is more about the process of withholding that money. In this article, we use both terms to refer to the same thing – withheld money.

If your retention of payment is 10% ($10,000 from a $100,000 total contract), then 10% will be withheld from each progressive payment – not a total of $10,000 from your last payment or at the very beginning of the project. This is an important distinction that contractors should keep in mind to avoid cash flow issues during the project.

Typically, contact retention is released, and the general contractor receives their complete payment at the end of the project. However, no law or rule says it has to be done this way. This is a subject of negotiation between the owner and contractor and can be determined by the contract itself.

Some contracts may have a specific milestone or percentage of completion where retainage is released, while others may hold it until final completion.

There is a chain effect when it comes to construction retainage. Usually, the owner holds back money from the general contractor, who in turn holds back money from their subcontractors and so on. And since subcontractors usually perform only a specific part of the project, their work is considered completed far before the general contractor’s work is completed.

As a result, subcontractors may wait longer to receive their retainage, especially if their part of the project is completed in the first stages of the project. Meanwhile, even if they aren’t yet paid for their completed work, subcontractors are still expected to pay their workers and suppliers on time, make payroll, and cover their other expenses.

This can create a significant financial burden for subcontractors, who may struggle to maintain positive cash flow throughout the project.

While retainage is a common practice in the construction industry, it’s not always mandatory. Some states and countries have laws that limit or prohibit the use of retainage, while others leave it up to the owner and contractor to negotiate.

The use of retainage also depends on the type of project and its complexity. For example, smaller residential projects may not include retainage, while larger commercial or public projects usually do.

Though a typical retainage percentage is 5-10%, this can vary depending on the project and jurisdiction. Certain states set upper limits on retainage, such as “no more than 5%” or “no more than 10%”, while others leave it up to the parties involved to negotiate the percentage.

Carefully studying local and federal laws and regulations, as well as understanding industry standards, can help contractors protect themselves from unreasonably high retainage percentages.

As one of the industries where maintaining positive cash flow is already a challenge for constructors because of the long payment cycles, withholding a specific sum of money from each payment can result in an even more significant financial burden.

Except for the countries or states where having a retainage in construction is obligatory, you are free to negotiate its absence or some other, safer alternative with the individual entity you do business with.

To make you informed and ready for discussion, we provide you with an overview of the retainage specifics by location.

Retainage is a common practice in many states across the United States. But, there are different rules depending on the location and project type.

Among private projects, the rules and regulations again vary from state to state.

Note! As state regulations frequently change, it is highly recommended that contractors consult local laws and regulations before signing a contract, verifying any information about retainage provided by this article for the time of reading.

This article mostly relies on the 2021 publication of the Foundation of the American Subcontractors Association, “Retainage Law in 50 States (2021),” which reflects some of the changes that took place since their last publication in 2018.

In parallel to having the right to keep retainage, project owners have an obligation to pay the retainage back if contractors, subcontractors, or material suppliers fulfill the contract terms – within a reasonable period of time – and if they have no outstanding issues at that point.

In case contractors discover the retainage withheld from them is not paid to them after all contract terms are fulfilled from their side, they should act promptly to file a claim for retainage due.

A mechanics lien, or construction lien, as it is sometimes called, is a legal claim on any property that has been improved by a general contractor or material supplier who has not been paid for their work.

This lien is attached to the property, granting the unpaid party a security interest in the property. So, if the claim is not settled and the owner doesn’t pay the contractor, the lien may lead to foreclosure of the property, forcing the owner to sell it and satisfy unpaid GC’s debt.

That’s one of the most effective methods of securing your retainage in construction, as liens put a big financial pressure on the property owner, so they will likely go to great lengths to avoid the potential consequences of a mechanics lien.

However, to effectively utilize mechanics lien, contractors need to follow strict regulations and deadlines established by each state.

While mechanics lien is only applicable to private projects, payment bond claims are used as security instruments in public construction projects. As the US government can’t tolerate claims against its interest in the land, a bond claim is secured by not the property interest but a payment bond.

So, a payment bond is a surety bond secured by a surety company that has guaranteed finances to secure the value of the project. If GC, subcontractor or material supplier are not paid after the successful completion of the project, they make a claim for payment against the payment bond and get their retainage fee back from the payment bond securities.

Withdrawing retainage in construction is not forbidden in Australia, so owners have all rights to withhold retention. According to the standards, the construction retention range is 5-10% of the general contract price and it’s largely dependent on the type of construction contract signed.

There is a retention clause in construction contracts that describes the amount that is retained, along with when and how will this withheld amount be paid back to the contractor.

If a construction project value is over $20 million, construction retainage should be put in a trust fund, and the head contractor is obliged to maintain the trust fund and give out annual account statements for Fair Trading.

There is a defects liability period clause – a period of 3-12 months after the reference date of the final payment or the date specified in the construction contract. During this time, a building expert inspects the property and assesses the quality of the contractor’s work. They determine if any defects need to be improved before final payment is made.

If, after the inspection, no defects are found or if the defects have been corrected within the allowed time frame, then the owner must release withheld retainage fees.

In case of any dispute, you can refer to a qualified person, known as an adjudicator, to initiate the alternative dispute resolution process, which usually falls outside of the court system and, therefore, is quicker and cheaper compared to litigation for resolving building disputes.

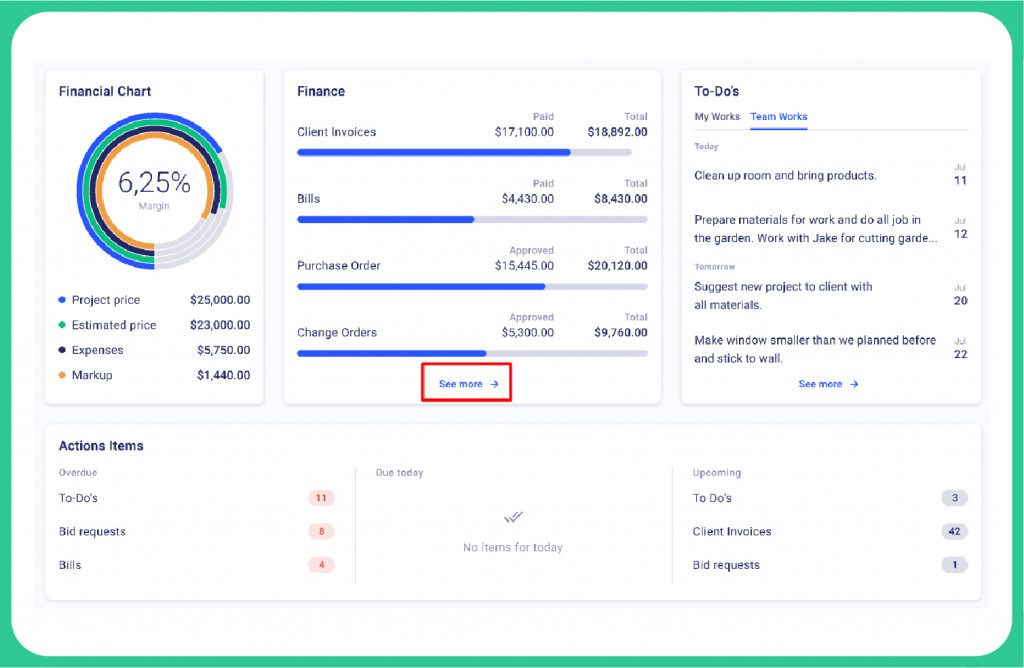

Though indirectly, construction project management software can help secure your retainage fee. With detailed and up-to-date contract records stored in one place, you have all the necessary information at hand when it comes to filing a lien or bond claim.

A construction management software records every project update – from the confirmed proposal with your customer to the final completion of the project – including schedule history, all invoices and their statuses, etc.

When you have a detailed record of the project, you can easily prove that your work was done correctly and within contract terms to receive your retainage fee.

Buildern is an all-in-one platform for every construction module you can think of. It syncs with Xero or QuickBooks and records all your transactions in one source. It also stores every interaction between you and suppliers by having purchase orders and bills recorded in one place and tracks when bills are due so nothing is missed.

Integrating Buildern into your construction process means that you are always armed with accurate and up-to-date information, enabling you to protect your retainage fee in case of any dispute easily and ensuring the smooth running of your construction projects.