Employer-sponsored insurance covers almost 155 million nonelderly people. 1 To provide current information about employer-sponsored health benefits, KFF conducts an annual survey of private and non-federal public employers with three or more workers. This is the twenty-third Employer Health Benefits Survey (EHBS) and reflects employer-sponsored health benefits in 2021.

For the second consecutive year, the COVID-19 pandemic has dominated public policy, including health care and employment policy. The survey was fielded from mid-January through July, which means we began collecting data before COVID vaccines were widely available and stopped interviews after a reasonably large share of the population (in at least some places) had been vaccinated. We revised the survey for 2021 to ask about changes employers and health plans made to address potential issues and uncertainties arising from the pandemic.

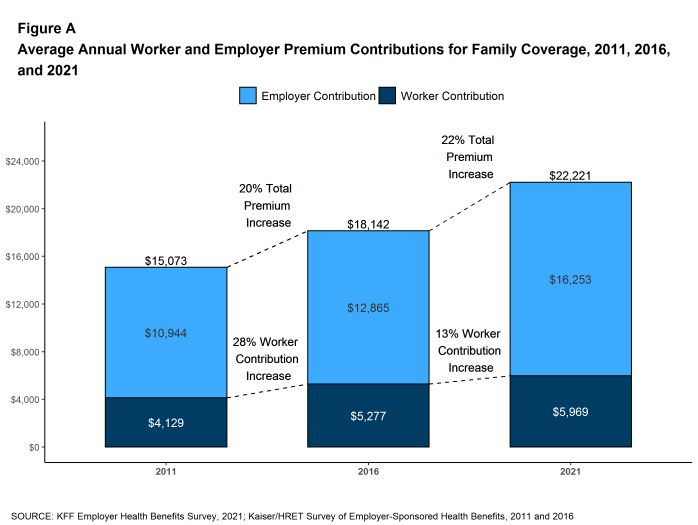

In 2021, the average annual premiums for employer-sponsored health insurance are $7,739 for single coverage and $22,221 for family coverage [Figure A]. The average single and family premiums increased 4% over the past year. During this period, workers’ wages increased 5% and inflation increased 1.9%. 2

The average premium for family coverage has increased 22% over the last five years and 47% over the last ten years [Figure A].

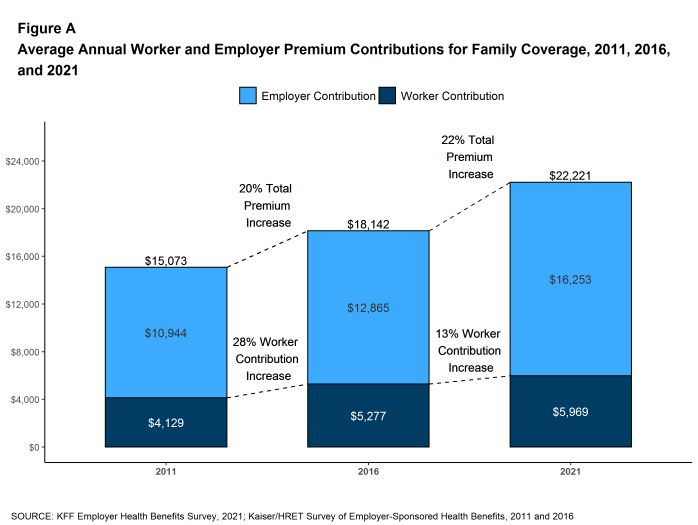

Covered workers in small and large firms have similar premiums for single coverage ($7,813 vs. $7,709) and family coverage ($21,804 vs. $22,389). The average premiums for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of the workers earn $28,000 annually or less) are lower than the average premiums for covered workers in firms with a smaller share of lower-wage workers for single coverage ($7,156 vs. $7,796) and family coverage ($20,315 vs. $22,407) 3 . The average premiums for covered workers in high-deductible health plans with a savings option (HDHP/SO) are lower that the overall average premiums for single coverage ($7,016) and family coverage ($20,802) [Figure B]. In contrast, the average premiums for covered workers enrolled in PPOs are higher that the overall average premiums for single ($8,092) and family coverage ($23,312).

Figure A: Average Annual Worker and Employer Premium Contributions for Family Coverage, 2011, 2016, and 2021

Figure B: Average Annual Worker and Employer Premium Contributions for Single and Family Coverage, by Plan Type, 2021

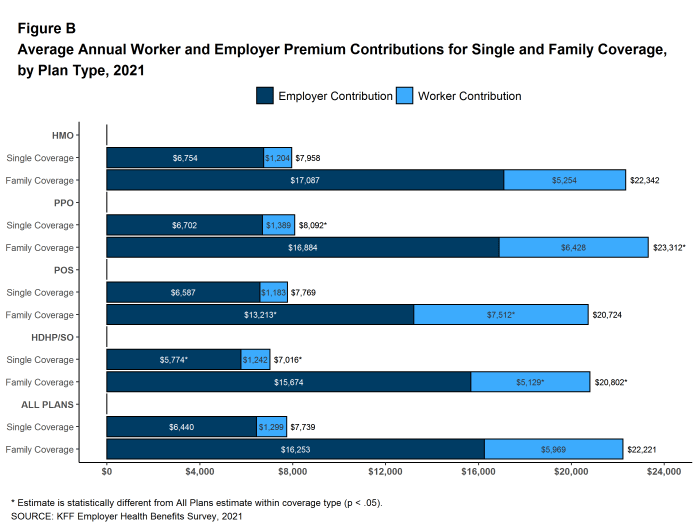

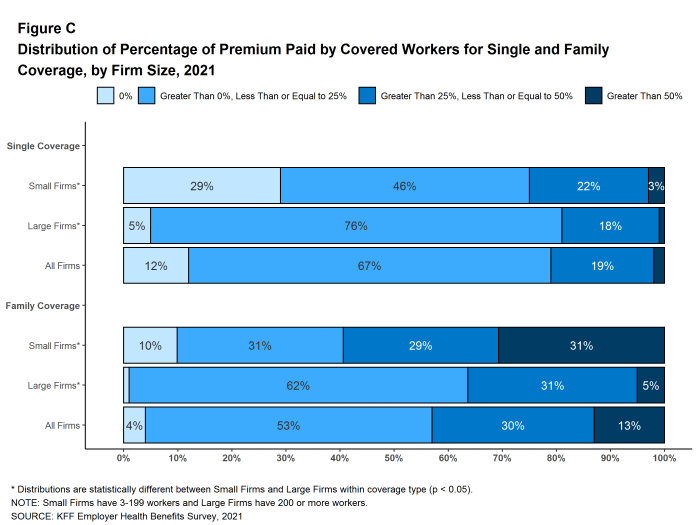

Most covered workers make a contribution toward the cost of the premium for their coverage. On average, covered workers contribute 17% of the premium for single coverage and 28% of the premium for family coverage. Covered workers in small firms on average contribute a higher percentage of the premium for family coverage than covered workers in large firms (24% vs. 37%). Covered workers in firms with a relatively large share of lower-wage workers have higher average contribution rates for family coverage than those in firms with a smaller share of lower-wage workers (35% vs. 27%). Covered workers at private for-profit firms on average contribute a higher percentage of the premium for both single and family coverage than covered workers at other firms, while covered workers in public firms on average contribute a lower percentage of the premium for both single and family coverage. Covered workers in firms with a relatively large share of younger workers (where at least 35% of workers are age 26 or younger) have higher average contribution rates for single coverage (23% vs. 17%) and for family coverage (35% vs. 28%) than those in firms with a smaller share of younger workers.

Twenty-nine percent of covered workers in small firms are in a plan where the employer pays the entire premium for single coverage, compared to only 5% of covered workers in large firms. In contrast, 31% of covered workers in small firms are in a plan where they must contribute more than one-half of the premium for family coverage, compared to 5% of covered workers in large firms [Figure C].

The average annual dollar amounts contributed by covered workers for 2021 are $1,299 for single coverage and $5,969 for family coverage, similar to the amounts last year. The average dollar contribution for family coverage has increased 13% since 2016 and 45% since 2011 [Figure A]. Eight percent of covered workers, including 20% of covered workers in small firms, are in a plan with a worker contribution of $12,000 or more for family coverage.

Figure C: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2021

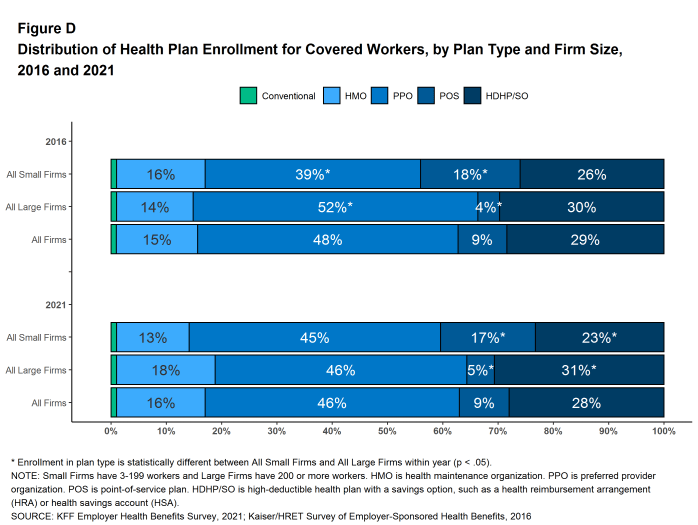

PPOs are the most common plan type, enrolling 46% of covered workers in 2021. Twenty-eight percent of covered workers are enrolled in a high-deductible plan with a savings option (HDHP/SO), 16% in an HMO, 9% in a POS plan, and 1% in a conventional (also known as an indemnity) plan [Figure D]. These percentages are each similar to the percentages for the corresponding plan type last year.

Figure D: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2016 and 2021

Many firms, particularly larger firms, self fund, or pay for some or all health services for their workers directly from their own funds rather than by purchasing health insurance.

Sixty-four percent of covered workers, including 21% of covered workers in small firms and 82% in large firms, are enrolled in plans that are self-funded. The percentage of firms offering health benefits that are self funded in 2021 is similar to the percentage last year.

Forty-two percent of small firms report that they have a level-funded plan, a much higher percentage than the previous two years. These arrangements combine a relatively small self-funded component with stoploss insurance which limits the employer’s liability to low attachment points that transfer a substantial share of the risk to insurers. These arrangements are complex and some small employers may not be entirely certain about the funding status of their plans. The substantial increase for 2021 suggests that that there may be a significant shift in the small group market toward health-status-based rating, so it will be important to monitor this trend over the next several years.

Most covered workers must pay a share of the cost when they use health care services. Eighty-five percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan.

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,669, similar to last year. The average deductible for covered workers is higher in small firms than large firms ($2,379 vs. $1,397). The average single coverage annual deductible among covered workers with a deductible has increased 13% over the last five years and 68% over the last ten years.

Deductibles have increased in recent years due to both higher deductibles within plan types and higher enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift to enrollment in HDHP/SOs does not necessarily do so if HDHP/SO enrollees receive an offsetting account contribution from their employers. Twenty-seven percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA), and 2% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while another 20% of covered workers in an HDHP with an HRA and 17% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their actual liability to less than $1,000.

We can look at the increase in the average deductible as well as the growing share of covered workers who have a deductible together by calculating an average deductible among all covered workers (assigning a zero to those without a deductible). The 2021 value of $1,434 is 17% higher than the average general annual deductible for single coverage of $1,221 in 2016 and 92% higher than the average general annual deductible of $747 in 2011.

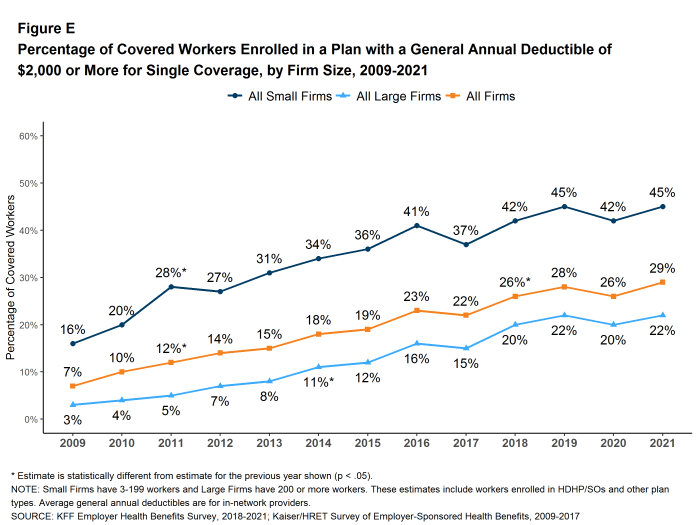

Another way to look at deductibles is the percentage of all covered workers who are in a plan with a deductible that exceeds certain thresholds. Over the past five years, the percentage of covered workers with a general annual deductible of $2,000 or more for single coverage has grown from 23% to 29% [Figure E].

Whether or not a deductible applies, a large share of covered workers also pay a portion of the cost when they visit an in-network physician. Most covered workers face a copayment (a fixed dollar amount) when they visit a doctor, although some workers face coinsurance requirements (a percentage of the covered amount). The average copayments are $25 for primary care and $42 for specialty care. The average coinsurance rates are 19% for primary care and 20% for specialty care. These amounts are similar to those in 2020.

Most workers also face additional cost sharing for a hospital admission or outpatient surgery. Sixty-eight percent of covered workers have coinsurance and 12% have a copayment for hospital admissions. The average coinsurance rate for a hospital admission is 20% and the average copayment is $321 per hospital admission. The cost sharing requirements for outpatient surgery follow a similar pattern to those for hospital admissions.

Virtually all covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, though the limits vary significantly. Among covered workers in plans with an out-of-pocket maximum for single coverage, 13% are in a plan with an out-of-pocket maximum of less than $2,000, while 27% are in a plan with an out-of-pocket maximum of $6,000 or more.

Figure E: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More for Single Coverage, by Firm Size, 2009-2021

Fifty-nine percent of firms offer health benefits to at least some of their workers, similar to the percentage last year. The likelihood of offering health benefits increase with firm size; only 49% of firms with 3 to 9 workers offer coverage, while virtually all firms with 1,000 or more workers offer coverage to at least some workers.

While the vast majority of firms are small, most workers work for large firms that offer coverage. In 2021, 91% of workers are employed by a firm that offers health benefits to at least some of its workers.

Although the vast majority of workers are employed by firms that offer health benefits, many workers are not covered by their own job. Some are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) while others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 81% of workers are eligible for the health benefits offered, and of those eligible, 77% take up the firm’s offer, resulting in 62% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to those in 2020.

Looking at workers in both firms that offer health benefits and firms that do not, 56% of workers are covered by health plans offered by their employer, similar to the percentage last year.

Most large firms and many small firms have programs that help workers identify health issues and manage chronic conditions, including health risk assessments, biometric screenings, and health promotion programs. Dislocations caused by the COVID-19 pandemic, including job disruptions, remote work, and social distancing, challenged workers’ abilities to participate in some of the activities associated with these programs. Some employers addressed these challenges by adjusting incentives, adding new services, vendors, or digital content, or by expanding service locations. For 2021, we modified our questions to focus on the changes made by employers to address challenges arising from the COVID-19 pandemic.

Biometric Screenings. Among firms offering health benefits, 26% of small firms and 38% of large firms provide workers the opportunity to complete a biometric screening. The percentage of large firms providing workers the opportunity to complete a biometric screening is lower than the percentage last year (50%). Among large firms offering health benefits, 16% not offering a biometric screening opportunity in 2021 reported offering a biometric screening opportunity in 2020.

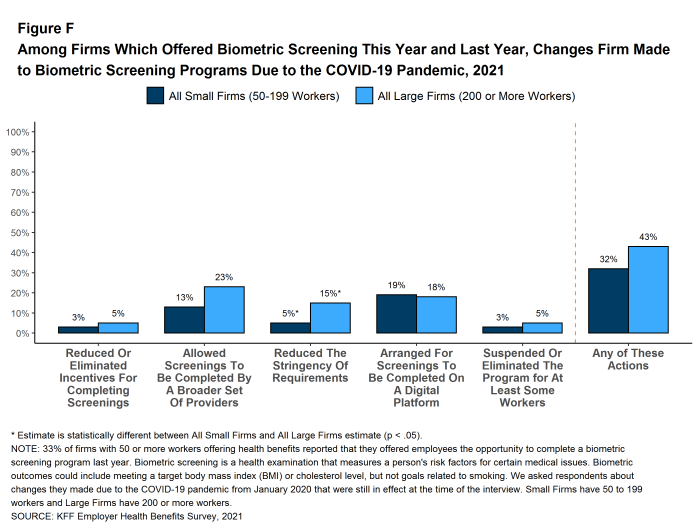

Firms with at least 50 employees offering a biometric screening opportunity both this year and last year were asked about changes that they have made to their programs since the start of the COVID-19 pandemic. Overall, among firms offering a biometric screening opportunity both this year and last year, 32% of smaller firms (50-199 employees) and 43% of larger firms report making some change in their biometric screening programs since the start of the COVID-19 pandemic [Figure F]. The changes include:

Figure F: Among Firms Which Offered Biometric Screening This Year and Last Year, Changes Firm Made to Biometric Screening Programs Due to the COVID-19 Pandemic, 2021

Health and Wellness Promotion Programs. Most firms offering health benefits offer programs to help workers identify and address health risks and unhealthy behaviors. Fifty-eight percent of small firms and 83% of large firms offer a program in at least one of these areas: smoking cessation, weight management, and behavioral or lifestyle coaching.

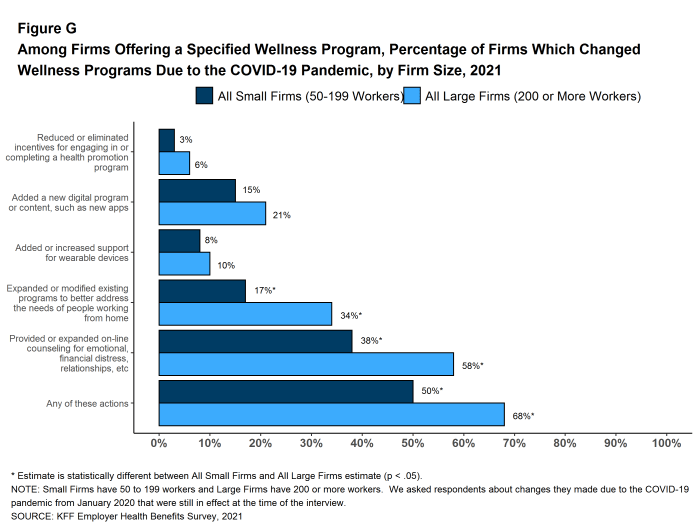

Firms with 50 or more employees with a wellness or health promotion program were asked if they made changes to their programs since the beginning of the COVID-19 pandemic. Overall, 50% of smaller firms (50-199 employees) and 68% of larger firms reported some type of change [Figure G].

Figure G: Among Firms Offering a Specified Wellness Program, Percentage of Firms Which Changed Wellness Programs Due to the COVID-19 Pandemic, by Firm Size, 2021

Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. While telemedicine was becoming an increasingly popular benefit prior to the COVID-19 pandemic, its use has increased dramatically since the pandemic began, drawing significant attention from policymakers. In 2021, 95% of firms with 50 or more workers that offer health benefits cover the provision of some health care services through telemedicine in their largest health plan, higher than the percentages last year (85%) and three years ago (67%).

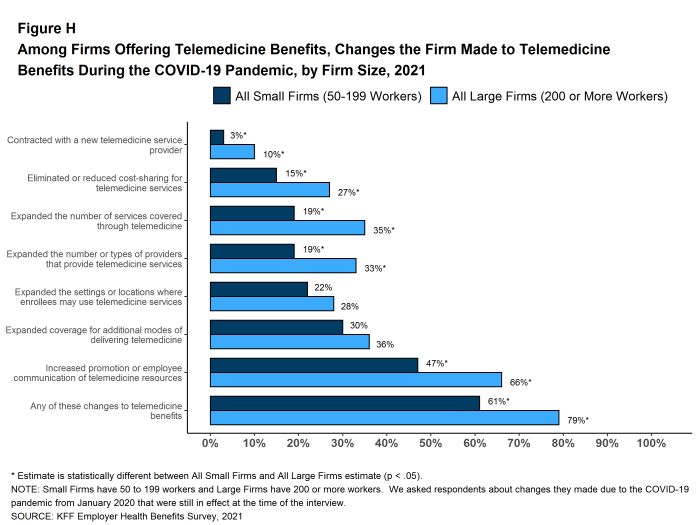

Employers with 50 or more employees offering telemedicine services were asked about changes they made to their programs after the beginning of the COVID-19 pandemic. Among these firms:

Figure H: Among Firms Offering Telemedicine Benefits, Changes the Firm Made to Telemedicine Benefits During the COVID-19 Pandemic, by Firm Size, 2021

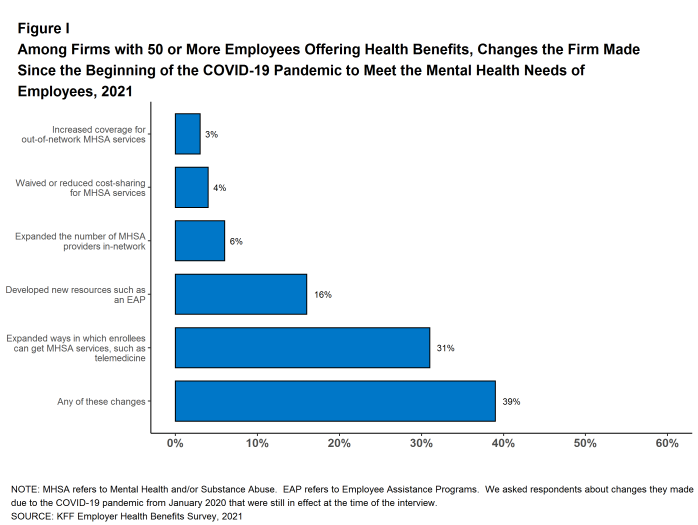

The social and economic disruptions caused by the COVID-19 pandemic have placed an unprecedented level of stress on people all over the world. Many employers took steps to assist employees and family members facing these stresses. Employers with at least 50 employees offering health benefits were asked about changes they made to their health plans after the start of the COVID-19 pandemic to support the mental health of their employees.

Figure I: Among Firms With 50 or More Employees Offering Health Benefits, Changes the Firm Made Since the Beginning of the COVID-19 Pandemic to Meet the Mental Health Needs of Employees, 2021

Among employers with 500 or more employees offering prescription drug benefits in 2021, 18% have programs that exclude subsidies from prescription drug manufacturers, such as coupons, from counting towards an enrollee’s deductible or out-of-pocket limit. Among these same employers, 13% made a change to their prescription program in the last two years to delay the inclusion of new high-cost drug therapies until the therapy is proven effective.

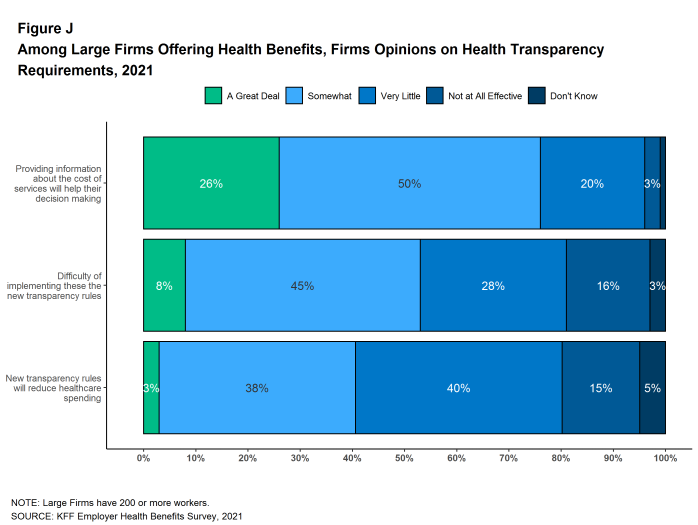

New federal rules will require health plans (including self-funded plans) make information available to enrollees about the estimated cost of services and cost sharing on a “real-time” basis. Twenty-six percent of large employers offering health benefits believe that providing employees with additional information about the cost of services will help their health care decision-making “a great deal” and an additional 50% say that it will help their decision-making “somewhat”. Employers were less certain about the impact of health care costs, with only 3% of large employers saying that the new transparency rules will reduce health spending “a great deal”, while 15% say that they will be reduce health spending “not at all.” Thirty-eight percent of these firms say that the new rules will reduce spending “somewhat” and 40% say that they will reduce spending “very little” [Figure J].

Figure J: Among Large Firms Offering Health Benefits, Firms Opinions On Health Transparency Requirements, 2021

The COVID-19 pandemic remains the most important story of 2021, and how employers are adapting their benefits to meet the changing needs of employees is the most important health benefit story. Overall market characteristics changed little: premiums continued on a modest growth trend, the share of people offered coverage at their work and the share of those covered by their jobs remained unchanged, as did the average deductible and other cost-sharing levels. While there was a modest amount of coverage loss, likely due to employment disruptions caused by the pandemic, the market was quite stable for the large share of enrollees who retained their coverage. 4

Employers did make a number of changes to their benefit programs and how services are delivered in response to COVID-19 challenges. One that has received a good amount of attention is telemedicine. Not only did the percentages of small and large employers with a telemedicine benefit increase again in 2021, but many employers also made the benefit easier to use by expanding the number and types of providers available, expanding the settings or locations where the benefit could be used, supporting additional modes of communicating with providers, or waiving cost sharing for telemedicine services. While some of these actions may change when the pandemic ends, employers appear convinced that telemedicine will continue to be important in the future. Almost half (47%) of employers with 50 or more employees offering health benefits agree that telemedicine will be very important in providing access in the future, while only 4% said that telemedicine would be unimportant in the future.

Another issue that has received a good deal of attention during the pandemic is mental health. The significant economic and social dislocations have placed unprecedented stresses on workers and their families, and some employers took steps to enhance benefits and access to services. Thirty-one percent of employers with 50 or more employees expanded the ways through which enrollees could get mental health or substance abuse services, such as through telemedicine, and sixteen percent developed new resources, such as an employee assistance program. These enhancements were timely, as 12% of employers with at least 50 employees, including 46% of firms with 5,000 or more employees, saw an increase in the share of employees using mental health services since the COVID-19 pandemic began.

Employers also made changes to their health promotion and wellness programs to adapt to the circumstances their workers faced during the pandemic, such as remote work. Fifty-five percent of firms with 50 or more employees made some type of change to their health promotion and wellness programs in response to the COVID-19 pandemic, including 17% that added a new digital program or digital content to their program and 43% that provided or expanded on-line counseling services for emotional or financial distress, relationship issues, or other stressful situations.

Looking ahead to 2022, the pandemic has not ended but the uncertainties seem fewer than at the beginning of 2021. One issue for both employment and health benefits is whether some of the changes brought about by the pandemic will endure. It was already apparent before the pandemic that more of the workforce could do their jobs remotely, but the pandemic proved the point. Whether and how employers structure benefits to support a potentially more far-flung workforce will be an important topic for the next few years. Similarly, it remains to be seen whether telemedicine will continue to grow as a source of access to care, or fade back to a more specialized option that is primarily available in difficult situations and hard to reach locations. During the pandemic, it has been a particularly important source for mental and behavioral heath care, an area of health care where provider access, at least within network, has been a longer-standing issue. This will be an area of particular interest going forward because enhanced access to these benefits may well increase costs. Another issue to watch will be the increase in level-funded premium plans among smaller employers. These plans use health status in underwriting and setting premiums in plans even for very small employers. We saw a large jump in the share of small employers with these plans in 2021, and if this continues, it could disrupt the community-rated pricing structure for ACA compliant small group plans.

The COVID pandemic has asked many questions of employers about their roles in assuring the health of their workers, their customers, and the public at large. Perhaps the most pressing issue currently is how to implement the federal vaccine requirement for employees of large employers, including policies about exceptions and whether or not to have incentives in addition to the requirement. Other complex issues have involved masking requirements, remote work, quarantines, assuring worker safety in interactions with coworkers and the public. Employers also have been challenged to make changes to their benefit plans to address the many health and social issues that have arisen during the pandemic, and many have done so. We can expect that employers will need to continue to adapt their programs as the pandemic continues into 2022.

The KFF 2021 Employer Health Benefits Survey reports findings from a survey of 1,686 randomly selected non-federal public and private employers with three or more workers. Researchers at NORC at the University of Chicago and KFF designed and analyzed the survey. Davis Research, LLC conducted the field work between January and July 2021. In 2021, the overall response rate is 15%, which includes firms that offer and do not offer health benefits. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance. Small firms have 3-199 workers unless otherwise noted. Values below 3% are not shown on graphical figures to improve the readability of those graphs. Some distributions may not sum due to rounding. This year, we made several changes to the survey questionnaire in order to reduce the length and burden of the survey. For more information on this change and other information on the survey methodology, see the Survey Design and Methods section at http://ehbs.kff.org/.

Filling the need for trusted information on national health issues, KFF is a nonprofit organization based in San Francisco, California.